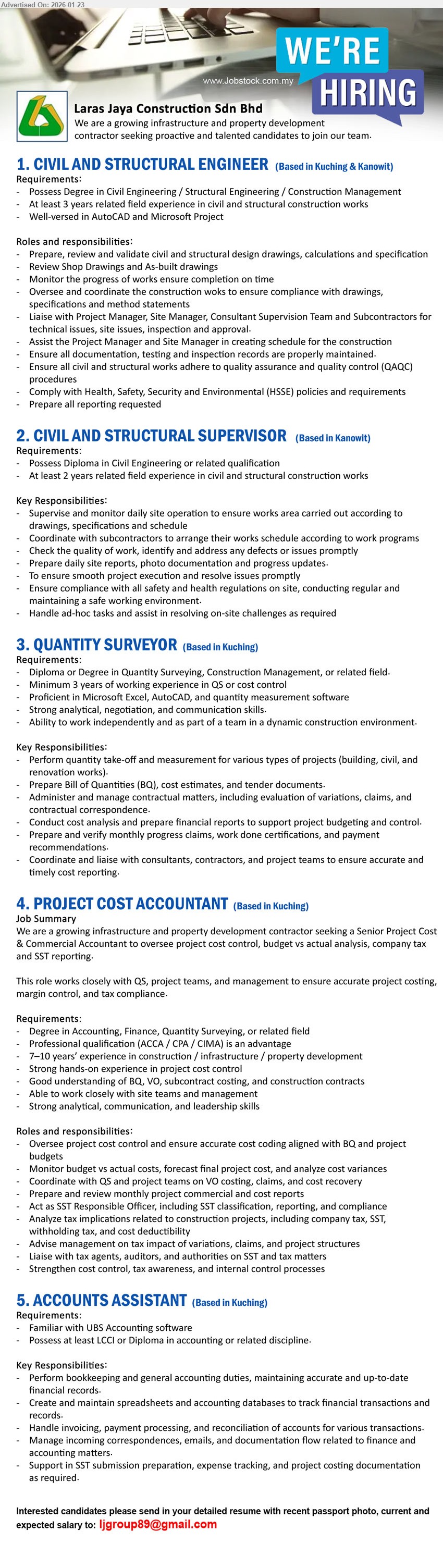

PROJECT COST ACCOUNTANT

PROJECT COST ACCOUNTANT (Based in Kuching)

Job Summary

We are a growing infrastructure and property development contractor seeking a Senior Project Cost

Commercial Accountant to oversee project cost control, budget vs actual analysis, company tax

and SST reporting.

This role works closely with QS, project teams, and management to ensure accurate project costing,

margin control, and tax compliance.

Requirements:

Degree in Accounting, Finance, Quantity Surveying, or related field

Professional qualification (ACCA / CPA / CIMA) is an advantage

7–10 years’ experience in construction / infrastructure / property development

Strong hands-on experience in project cost control

Good understanding of BQ, VO, subcontract costing, and construction contracts

Able to work closely with site teams and management

Strong analytical, communication, and leadership skills

Roles and responsibilities:

Oversee project cost control and ensure accurate cost coding aligned with BQ and project budgets

Monitor budget vs actual costs, forecast final project cost, and analyze cost variances

Coordinate with QS and project teams on VO costing, claims, and cost recovery

Prepare and review monthly project commercial and cost reports

Act as SST Responsible Officer, including SST classification, reporting, and compliance

Analyze tax implications related to construction projects, including company tax, SST, withholding tax, and cost deductibility

Advise management on tax impact of variations, claims, and project structures

Liaise with tax agents, auditors, and authorities on SST and tax matters

Strengthen cost control, tax awareness, and internal control processes